In brief

- Wisconsin Democrats have introduced two identical bills within weeks to tighten rules on crypto kiosks amid rising fraud losses.

- The proposals require money transmitter licenses, strict ID verification, fraud alerts, and caps on fees and daily transaction limits.

- Lawmakers cite a 99% surge in fraud complaints in 2024, with reported victim losses nearing $247 million.

Wisconsin lawmakers have filed their second legislative attempt in two weeks to crack down on crypto kiosks, in response to a nationwide surge in fraud that they say cost victims nearly $247 million last year.

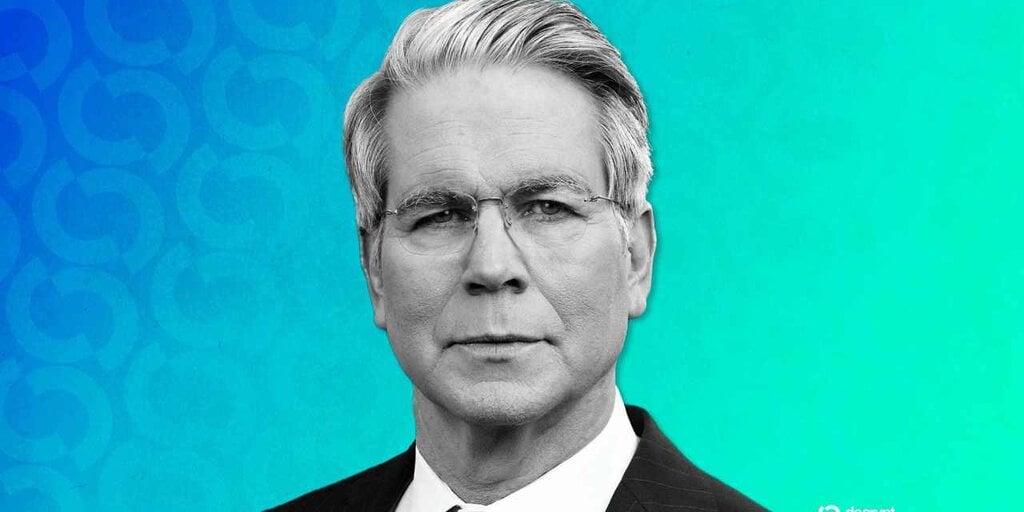

Senate Bill 386, filed Monday by Senator Kelda Roys alongside six colleagues, echoes Assembly Bill 384, introduced last month by Rep. Ryan Spaude (D-Wis.) and ten co-sponsors.

The moves hint at urgency from Democrats to control digital currency terminals scattered across gas stations and grocery stores statewide.

Both bills arrive as the Treasury Department’s Financial Crimes Enforcement Network has issued an urgent alert documenting a 99% spike in crypto kiosk fraud complaints throughout 2024, with reported victim losses jumping 31% to nearly $247 million.

The measures would force terminal operators into Wisconsin’s money transmitter licensing system while establishing consumer protections, including mandatory fraud alerts, identity verification protocols, and spending restrictions.

Wisconsin hosts 582 Bitcoin ATMs among 31,439 operating nationwide, according to Coin ATM Radar.

The identical bills share the same regulatory framework and requirements, with both referred to the Committee on Financial Institutions.

Daily exchange limits are capped at $1,000 per customer while also curbing operator fees at “$5 or 3 percent of the transaction amount.”

Each machine must also prominently display warnings that “FRAUD ALERT! Criminals seek to defraud virtual currency customers by impersonating loved ones, government officials, law enforcement officers, or charities,” per the bills.

“While crypto ATMs were developed as a natural extension of the crypto ecosystem, enabling convenient purchases through physical kiosks, the absence of robust KYC protocols has made them vulnerable to money laundering and illicit activities,” said Arjun Vijay, founder of crypto exchange Giottus, told Decrypt.

The bills mandate comprehensive identity collection, including names, birthdates, addresses, phone numbers, and government-issued photo identification before any initial transaction.

“While it may limit high-value trades and reduce anonymity, it builds public trust, paving the way for safer, more credible digital currency adoption in everyday transactions,” Dileep Kumar H V, director at Digital South Trust, told Decrypt.

The proposals also include mandatory refund policies for fraud victims who alert authorities within 30 days, addressing concerns over crypto losses among elderly targets.

Wisconsin’s action follows similar crackdowns internationally, with Australia implementing transaction limits and New Zealand preparing complete prohibitions.

In the U.S., Washington’s Spokane city council voted to completely eliminate crypto kiosks following federal investigations into billions in fraud-related losses.

Both Wisconsin bills now await committee review in their respective chambers, with customer identification requirements taking effect 60 days after passage if approved.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.