In brief

- Bitcoin’s single-day hash rate—a measurement of computing power—hit an all-time high of 1.279 on Tuesday.

- The hash rate also reached a moving average record for seven days.

- Miners, who work to secure Bitcoin’s network, have faced various challenges.

Bitcoin‘s single-day hash rate on Tuesday hit a new high of 1.279 zettahash per second (ZH/s), according to mining data platform CoinWarz, even as the price of the asset remained roughly flat over the past 24 hours.

The hash rate also reached a moving average high for seven days, surpassing 1 ZH/s for the period.

The increases come, despite miners ongoing struggles with rising energy costs and lower rewards. After last year’s halving, the payoff for miners has fallen to 3.125 bitcoin, down from 6.250 previously.

Miners typically rely on the price of Bitcoin to go up to cover costs but continued volatility for the asset has spurred some large miners to branch into high-powered computing.

Hash rate is the measurement of all the computing power on the leading cryptocurrency’s network.

Hash computations—or hashing—is the process of turning data into a fixed-length string of characters. It’s needed to do things on the Bitcoin network, like creating private keys so users can make transactions.

1 ZH/s means that per second, the computers securing the Bitcoin network are doing one sextillion (1,000,000,000,000,000,000,000) hashes every second—an absurdly large number.

Bitcoin, other than being a digital coin, is a payment network with operations processing transactions scattered worldwide.

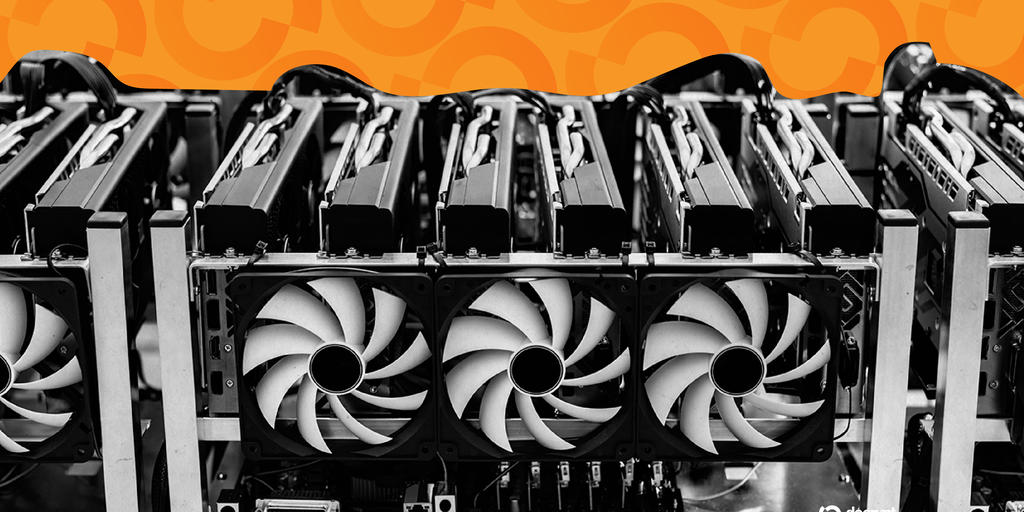

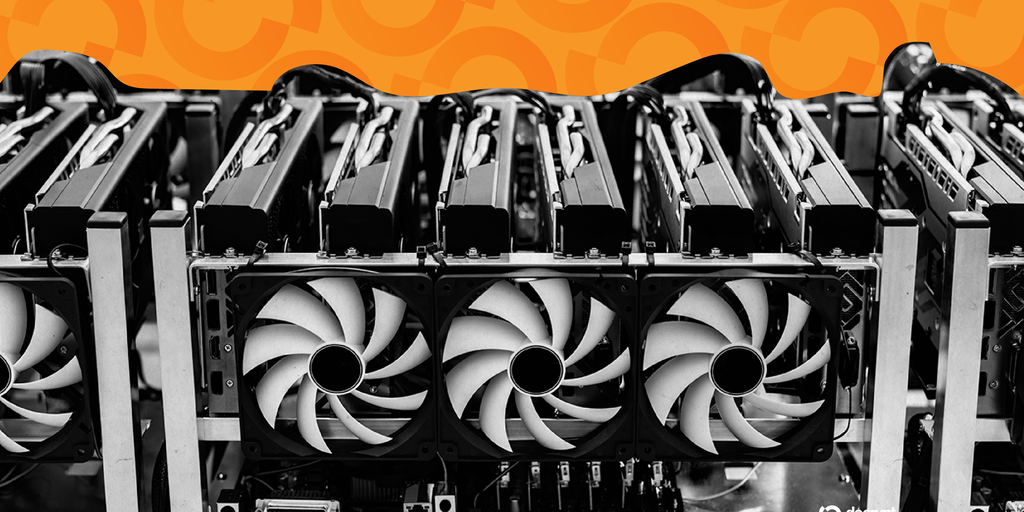

The operations processing transactions—known as miners—race to solve puzzles and are rewarded for doing so. In order to take part, they must use huge amounts of computing power.

A high hash rate is important because it means more computing power is being used to keep the cryptocurrency’s network secure. And the more computing power used, the harder it is for attackers to take control of more than 50% of the Bitcoin network.

It also means there is more mining activity on the network as miners expand their operations and use more machines—and power—to continue minting coins.

Bitcoin miners are typically large operations run by companies in warehouses that use lots of electricity to process transactions on the virtual coin’s network and mint new coins.

The aggregate hash rate for the world’s largest digital asset was previously concentrated in China. Following the country’s ban on Bitcoin mining in May 2021, companies were forced to move elsewhere to set up their operations.

Since then, North America has become the most dominant player in the Bitcoin mining space.

https://twitter.com/pete_rizzo_/status/1962937690397012252

The increased seven-day hash rate comes as miners wrestle with rising energy costs and lower rewards. After last year’s halving, the payoff for miners is 3.125 bitcoin, down from 6.25 previously.

Miners typically rely on the price of Bitcoin to go up to cover costs but continued volatility for the asset has spurred, some large miners tobranch into high-powered computing.

Bitcoin was recently trading for $111,985 per coin, according to CoinGecko data, unmoved over 24 hours. The coin has also barely budged over a seven-day period, but it hit a new high of $124,128 in August.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.