Morning Minute is a daily newsletter written by Tyler Warner. The analysis and opinions expressed are his own and do not necessarily reflect those of Decrypt. Subscribe to the Morning Minute on Substack.

GM!

Today’s top news:

- Crypto majors green, led by SOL; BTC at $115,000

- SOL hits $238 on back of FORD DAT $1.65B raise; SOL memes + infra up

- BlackRock to tokenize ETFs and RWA funds, pending regulatory approval

- Sharps Technology partners with Pudgy Penguins for marketing

- DOGE up 20% on week ahead of ETF launch

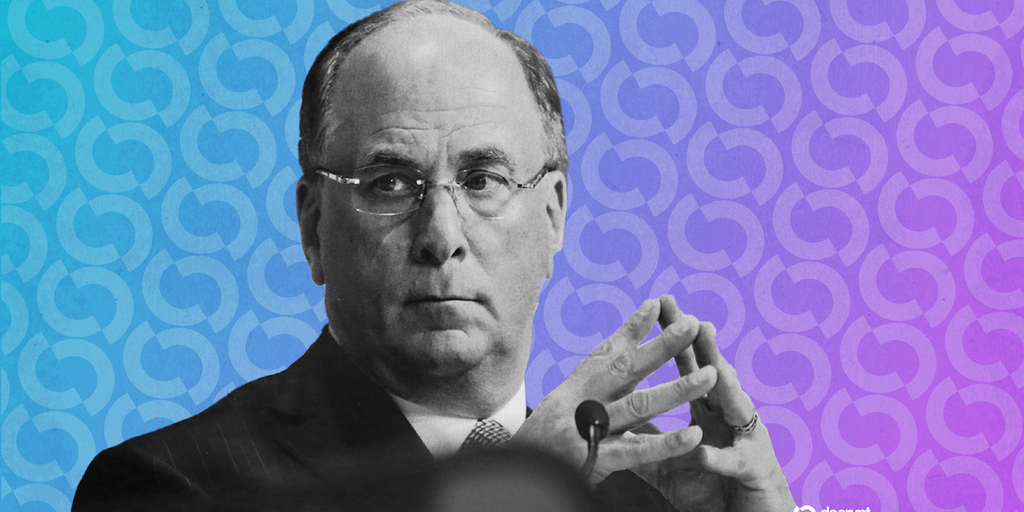

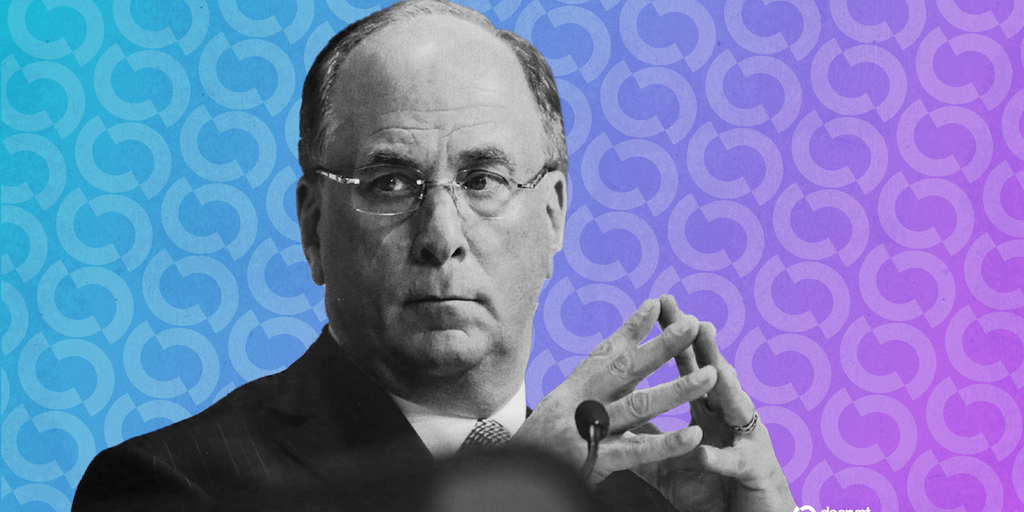

🏦 BlackRock Eyes Tokenized ETFs

Wall Street’s biggest asset manager is about to take tokenization mainstream.

📌 What Happened

Bloomberg reported that BlackRock is preparing to tokenize ETFs and other real-world asset (RWA) funds, expanding beyond its existing on-chain cash management product, BUIDL.

The move is pending regulatory approval, but it represents a major step toward bringing traditional investment vehicles onto blockchain rails.

BlackRock launched BUIDL with Securitize in 2024, giving institutions tokenized exposure to U.S. Treasuries.

Now, the firm wants to extend that model to ETFs and additional fund structures, which would mark the first time a traditional manager has tokenized mainstream funds at scale.

Potential types of funds include:

- Equity ETFs

- Bond / fixed income funds

- Money Market funds

- Real Estate funds

- Private Credit funds

These sectors represent Trillions in assets ($12.5T in Q2 2025 to be exact). And a huge chunk of them (maybe eventually all) are coming on-chain.

🗣️ What They’re Saying

“Just like everyone downplaying digital assets being proven wrong over the last decade. Those downplaying tokenization will likely be proven wrong as well” – James Seyffart, Bloomberg

“BlackRock is tokenizing their ETFs and you’re bearish? Everything will be tokenized.” -Graeme Moore, Head of Strategy at Project 11

reminder:

all ETFs and all equities will eventually be tokenized

because assets will naturally flow to where they can be used as the most efficient collateral

and most of that lending/borrowing will happen on Ethereum L1/L2 https://t.co/ulTmfcsBRA

— DCinvestor (@iamDCinvestor) September 12, 2025

🧠 Why It Matters

So why do we care about tokenization of real world assets?

Tokenized ETFs would:

- Timing: Enable 24/7 settlement and faster transfers

- Composability: Plug assets from these funds into other areas of DeFi

- Signal: Crypto becomes “too big to fail” once giants like BlackRock move their entire books on-chain

And bringing these assets onchain grows the overall crypto market cap.

No, it doesn’t mean that new liquidity will flock to every alt L1 or meme coin.

But it’s not a stretch to think it will flow to the best assets, and it will certainly send stablecoinx up significantly. DeFi assets would likely win as well.

And there’s a real chance that most of these funds are tokenized on Ethereum (where BUIDL is).

If that’s the case, ETH is likely the biggest winner here.

So this is a big one to root for the regulators to approve.

And once BlackRock gets the approval and executes, everyone else will follow.

🌎 Macro Crypto and Memes

A few Crypto and Web3 headlines that caught my eye:

- Crypto majors are green with SOL outperforming; BTC +1% at $115,000, ETH +2% at $4,520, XRP +1% at $3.03, SOL +6% at $239

- M (+11%), MYX (+8%) and PUMP (+8%) led top movers

- The BTC ETFs saw $552.7M in net inflows yesterday, now at $1.93B in net inflows since September began

- BlackRock is working on tokenizing ETFs and other real-world asset (RWA) funds according to Bloomberg

- PayPal pitched Hyperliquid on expanding its network across PayPal’s 400M accounts

- Coinbase accused the SEC of deleting Gary Gensler’s text messages during the critical crypto crackdown years

- Rex-Osprey’s ETFs for BTC, XRP, DOGE, BONK, and TRUMP have passed the SEC’s 75-day window and are scheduled to launch today

- Crypto lender Figure saw its shares finish 24% above their IPO price in the company’s Nasdaq debut

In Corporate Treasuries

In Memes

- Memecoin leaders are green led by DOGE; DOGE +4%, Shiba +2%, PEPE +2%, PENGU +1%, BONK +2%, TRUMP even, SPX even, and FARTCOIN +4%

- Dogecoin has jumped 20% this week, as a treasury firm accumulates DOGE and ahead of the DOJE DOGE ETF launching today

- SPARK (+68%), KORI (+60%) and YAC (+1900%) led on-chain movers

💰 Token, Airdrop & Protocol Tracker

Here’s a rundown of major token, protocol and airdrop news from the day:

- PUMP got listed on Upbit on Thursday, rallying as high as $0.06 ($6B FDV); daily active PUMP app users have passed 35k

- World Liberty Fi proposed using 100% of WLFI fees to buy and burn WLFI

- Collector Crypt’s CARDS token jumped 18% to $517M after another $1.3M gacha pack sellout

🤖 AI x Crypto

Section dedicated to headlines in the AI sector of crypto:

- Overall market cap up 2% at $14.1B, leaders were green

- FARTCOIN (+2%), VIRTUAL (+2%), TIBBIR (-3%), aixbt (+1%) & ai16z (+2%)

- LEA (+23%), simmi (+20%) and Acolyt (+17%) led top movers

🚚 What is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

- ETH NFT leaders were mixed; Punks -2% at 46.3 ETH, Pudgy +2% at 10.5, BAYC -2% at 9.15 ETH

- Abstract NFTs were mixed, led by Dreamilio (+17%)

- Pudgy Party hits 500k downloads across Apple and Google app stores

- Moonbirds announced a mystery physical collectible mint open for 24 hours

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.