Morning Minute is a daily newsletter written by Tyler Warner. The analysis and opinions expressed are his own and do not necessarily reflect those of Decrypt. Subscribe to the Morning Minute on Substack.

GM!

Today’s top news:

- Crypto majors green, SOL leads again; BTC at $112,700

- Tom Lee 30x’s Moonshot bet on OCTO (WLD +75%)

- HYPE hits a new ATH at $55 amidst ongoing stablecoin proposals

- MegaETH introduces its mUSD stablecoin, partnering with Ethena

- OpenSea drops new mobile app, Flagship NFT Fund & new rewards program

🌊 OpenSea’s Next Act: Mobile, Flagship, and the Final Sprint to $SEA

OpenSea is clearly trying to be more than “just an NFT marketplace.”

And yesterday’s reveal pushed it toward an on-chain trading superapp with AI at the core, a seven-figure cultural fund, and a gamified final rewards push ahead of the $SEA token event.

📌 What Happened

OpenSea made a series of product announcements yesterday shaping the near-term future of the protocol.

The announcements included:

- A reimagined OpenSea Mobile app with AI-native trading

- A new Flagship NFT Collection (a seven-figure treasury for historic and emerging NFTs starting with CryptoPunk #5273)

- Details around the final pre-TGE rewards phase in which 50% of platform fees funnel to user rewards

The team also shared that $SEA details are coming in early October.

Perhaps most relevant for users is the last point – the new rewards program.

The final pre-TGE rewards starts Sept 15 and will leverage 50% of all platform fees (1% for NFTs, 0.85% for tokens) to power a “prize vault,” seeded with $1M of OP and ARB.

Users get a Starter Treasure Chest in the Rewards Portal and can level up by trading across 22 chains, completing daily Voyages, and collecting Shipments.

And don’t worry if you haven’t bought an NFT in a long time. Historical users will receive their own SEA allocation from the OpenSea Foundation at TGE based on historical volume and other factors.

🗣️ What They’re Saying

“I’ve been building OpenSea since 2017. I can safely say it’s my life’s work, and it comes with the conviction to take big swings.

With OS2, we decided to rebuild our tech, product, and operating culture from the ground up. We deliberately “slowed down to speed up”.

Now we get to accelerate. We’re entering the most exciting period in our history as a company, as we evolve OpenSea into the best place to trade everything onchain.” – Devin Finzer, OpenSea CEO on X

In Q4, the $SEA TGE could be the biggest liquidity event in NFT history.

OpenSea’s V2 comeback has rebuilt massive goodwill in the community – there’s no way they fumble this

— seedphrase (@seedphrase) September 9, 2025

🧠 Why It Matters

This is arguably the most bullish announcement from OpenSea in its existence.

AI-native mobile is the right choice – the OpenSea mobile app has been lagging for a long time and due for an upgrade. A good mobile app is table stakes to lay the foundation for future trading.

The Flagship fund is equally strategic: it shows that they “get” NFTs and care about them, and will likely garner some positive sentiment from various NFT communities of which they buy.

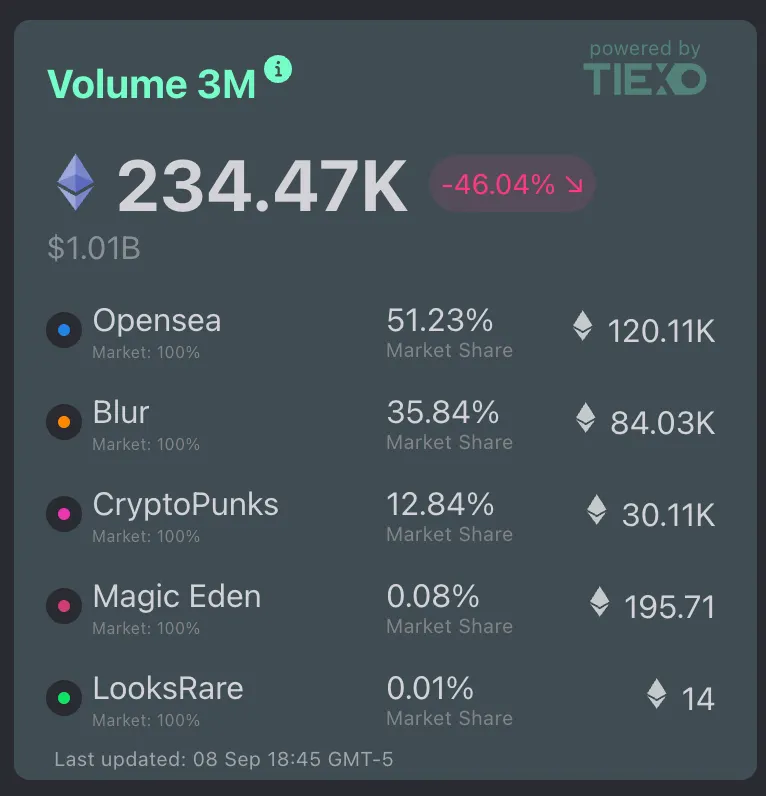

And routing half of fees is a big move to drive incentivized trading (i.e. farming) and boost those volumes ahead of TGE. Some have complained about the doubling of the fee (from 0.5% to 1%), but the reality is, it’s a toll most will be willing to pay for the rewards.

As for impact, expect a pickup in on-platform volumes, a bid for marquee collections (Punks and other Flagship-adjacent sets), and renewed airdrop farming as users level chests across 22 chains.

The $SEA narrative now has a calendar – users will position into the Sept 15 rewards launch and then hold for early-October TGE details.

What I’m watching next:

- The mobile beta waitlist timing and how quickly “OpenSea Intelligence” becomes genuinely useful (alerts, portfolio context, cross-chain routing).

- The cadence and rationale behind Flagship acquisitions, plus committee disclosures and community reception.

- Rewards portal UX on Sept 15, fee-to-rewards transparency, and how effectively the program attracts token traders (not just NFT collectors).

- The Foundation’s $SEA specifics in early October: emissions, utility, governance, and long-term sink/source design.

But for now, OpenSea has put itself in a good place.

Let the sprint to SEA begin…

🌎 Macro Crypto and Memes

A few Crypto and Web3 headlines that caught my eye:

- Crypto majors are slightly green with SOL leading; BTC +0.5% at $112,700, ETH +0.5% at $4,340, XRP +2% at $3, SOL +2% at $217

- MYX (+185%), WLD (+74%), NEAR (+10%) and MNT (+10%) led top movers

- HYPE hit a smashing new ATH at $55 amidst its ongoing stablecoin auction

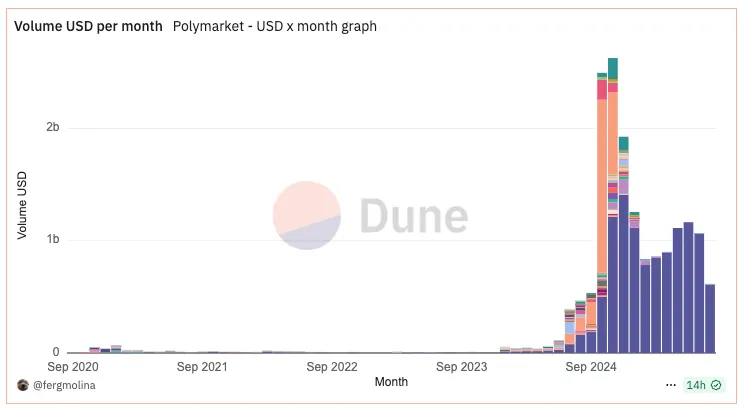

- Odds of a 50 bps cut in September jumped to 19% on Polymarket, nearly doubling on the day

- The BTC ETFs saw their biggest inflows in a month on Monday with $364M in net inflows

- The Nasdaq filed proposals with the SEC to enable tokenized stock trading and settlement options

- A senior adviser to Vladimir Putin claimed the U.S. is using crypto and gold to inflate away its debt at global expense

- Tom Lee said Bitcoin could “easily” reach $200K in 2025, citing policy easing and liquidity

- Cantor Fitzgerald introduced a Bitcoin fund that pairs BTC upside with a gold-based insurance hedge

- Security researchers (and Ledger’s CTO) warned of a large supply-chain exploit that could affect apps and wallets and advised users to pause risky transactions (though less than $100 in exploits were found)

- CoinShares announced plans to go public in the U.S. via a $1.2B SPAC deal with Vine Hill

- Congress introduced a bill requiring the Treasury to detail how it will custody federally owned Bitcoin, including coins in the Strategic Bitcoin Reserve

In Corporate Treasuries

- HashKey launched a $500M Digital Asset Treasury fund to channel traditional capital into on-chain treasuries focused on BTC and ETH.

- Eightco’s (OCTO) stock spiked 3,000% after the company said it would hold Worldcoin (WLD) as a primary treasury asset and invest in BitMine

- Lion Group announced a reallocation of its corporate treasury from SOL & SUI to HYPE

In Memes

- Memecoin leaders are very green on the day; DOGE +3%, Shiba +3%, PEPE +6%, PENGU +7%, BONK +7%, TRUMP +3%, SPX +8%, and FARTCOIN +7%

- Launchcoin soared 50% to $125M as a $7M short got liquidated (now back to $90M); PEPECOIN was a top onchain mover, jumping 39x to $3.5M

- SPX is getting listed on Coinbase today

💰 Token, Airdrop & Protocol Tracker

Here’s a rundown of major token, protocol and airdrop news from the day:

🤖 AI x Crypto

Section dedicated to headlines in the AI sector of crypto:

- Overall market cap up 5% at $13.7B, leaders were very green

- FARTCOIN (+7%), VIRTUAL (+10%), TIBBIR (+5%), aixbt (+11%) & ai16z (+21%)

- ai16z (+21%) and GOAT (+19%) led top movers

- The SEC met with several companies on Monday to discuss the convergence of crypto and AI

🚚 What is happening in NFTs?

Here is the list of other notable headlines from the day in NFTs:

- ETH NFT leaders were mixed; Punks -0.5% at 48.3 ETH, Pudgy +2% at 10.5, BAYC +3% at 9.25 ETH

- Abstract NFTs were mixed, led by RUYUI (+45%)

- Christie’s announced that they have closed their Digital Art department, with multiple staffers let go

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.