Crypto and the age of alternative payroll

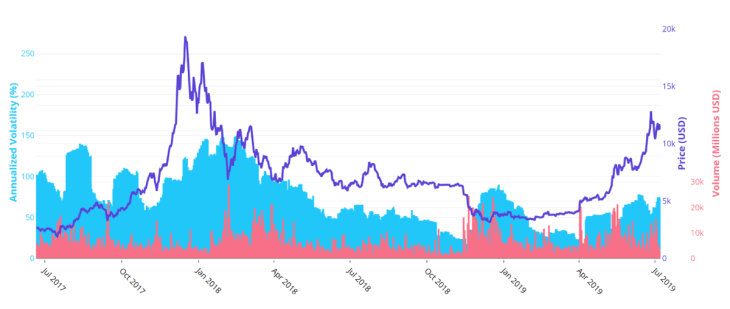

By Pranesh Anthapur, Kraken Chief People Officer Payroll capabilities are expanding alongside vast improvements to blockchain technology. With these innovations, global employees may want a wider range of digital asset options, such as NFTs, cryptocurrencies, and bitcoin IRAs. Let’s explore why and how to empower employees with unprecedented control over their financial future. The global…