Bitcoin Braces for Fed Balance-Sheet Shift as Liquidity Cycle Turns

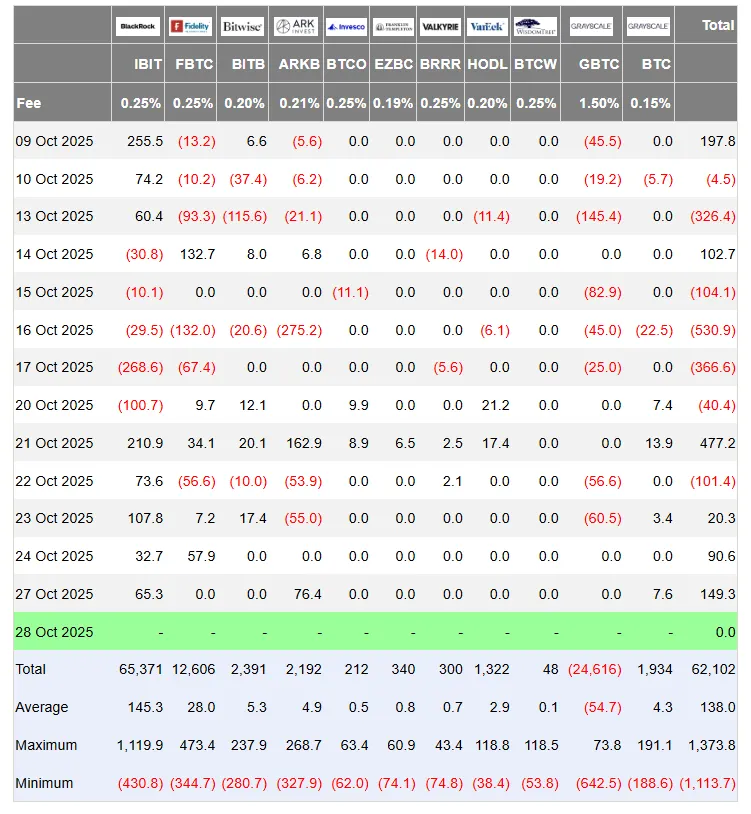

In brief The Fed’s end of quantitative tightening places Bitcoin at a critical liquidity juncture. Aside from short-term volatility, the crypto market is unlikely to repeat the post-Fed pivot scenario of 2019 amid higher interest rates and institutional demand, Decrypt was told. A favorable macro and geopolitical outlook could extend the bull run, analysts say.…