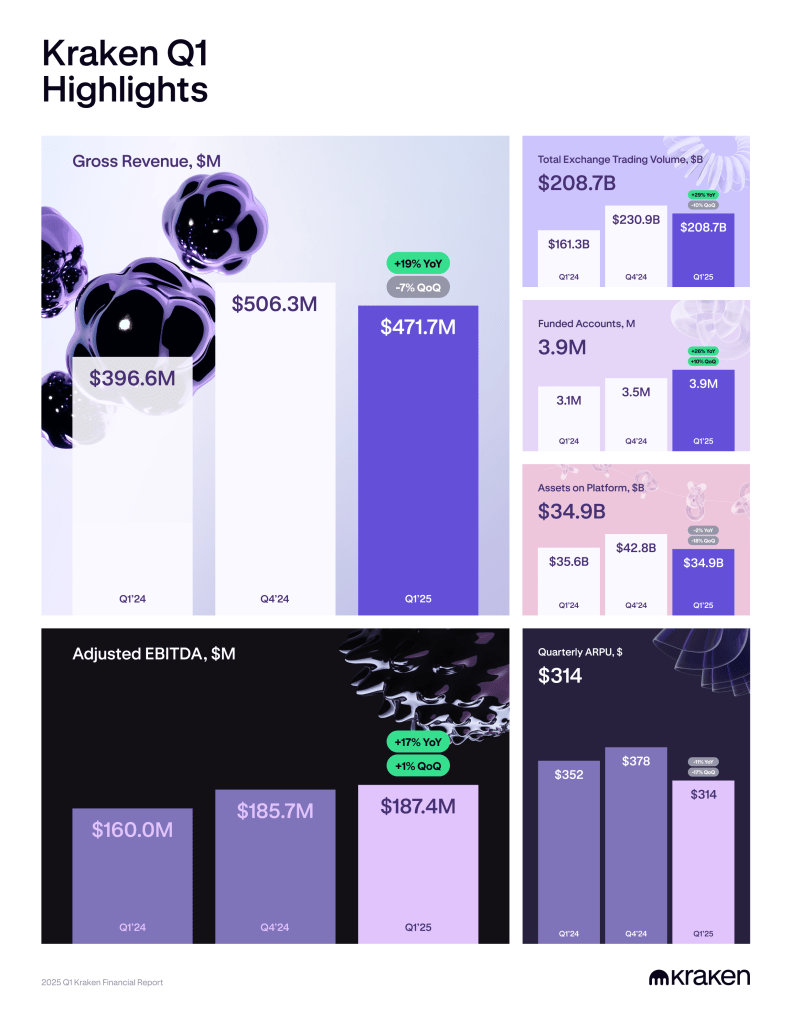

Kraken Q1 2025 financial update: Strength through market cycles

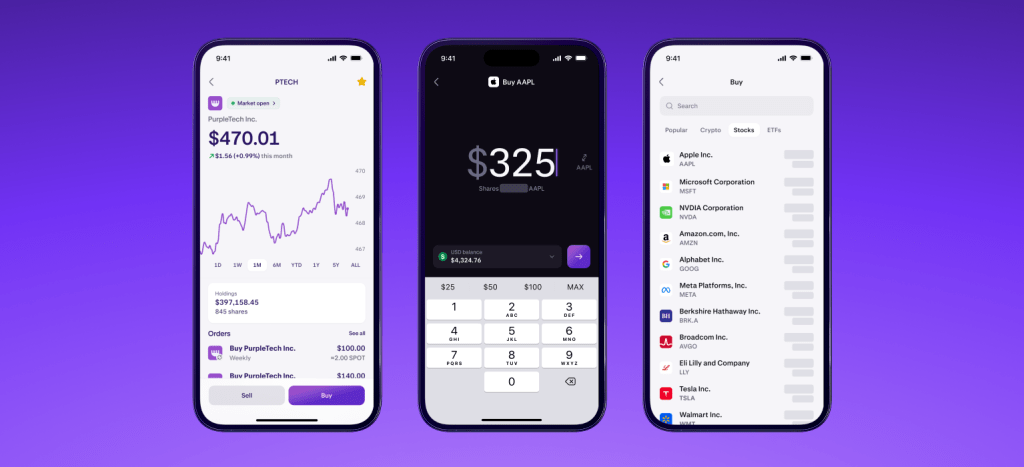

Kraken began 2025 building on 2024’s solid momentum, navigating a shifting and softening market to outperform, even growing volume share. Our sustained performance across cycles demonstrates the resiliency of our platform, which continues to attract new clients and deepen existing relationships. We took a meaningful step toward our multi-asset vision by acquiring NinjaTrader, and rolled…