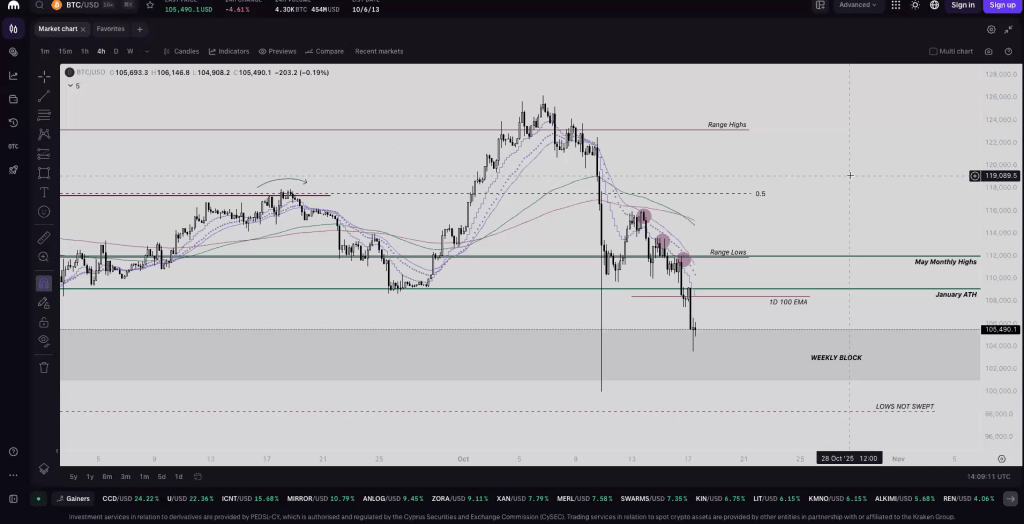

Crypto Leverage Trading a ‘Major Problem’, Says Former FTX US President

In brief Former president of FTX US, Brett Harrison, told Decrypt that offering leverage up to 1,001x on volatile crypto assets is “irresponsible” and a “major problem.” Proponents of the high-leverage crypto products believe they’re just giving retail users what they want and offering a level playing field. Harrison’s comments come as he is preparing…