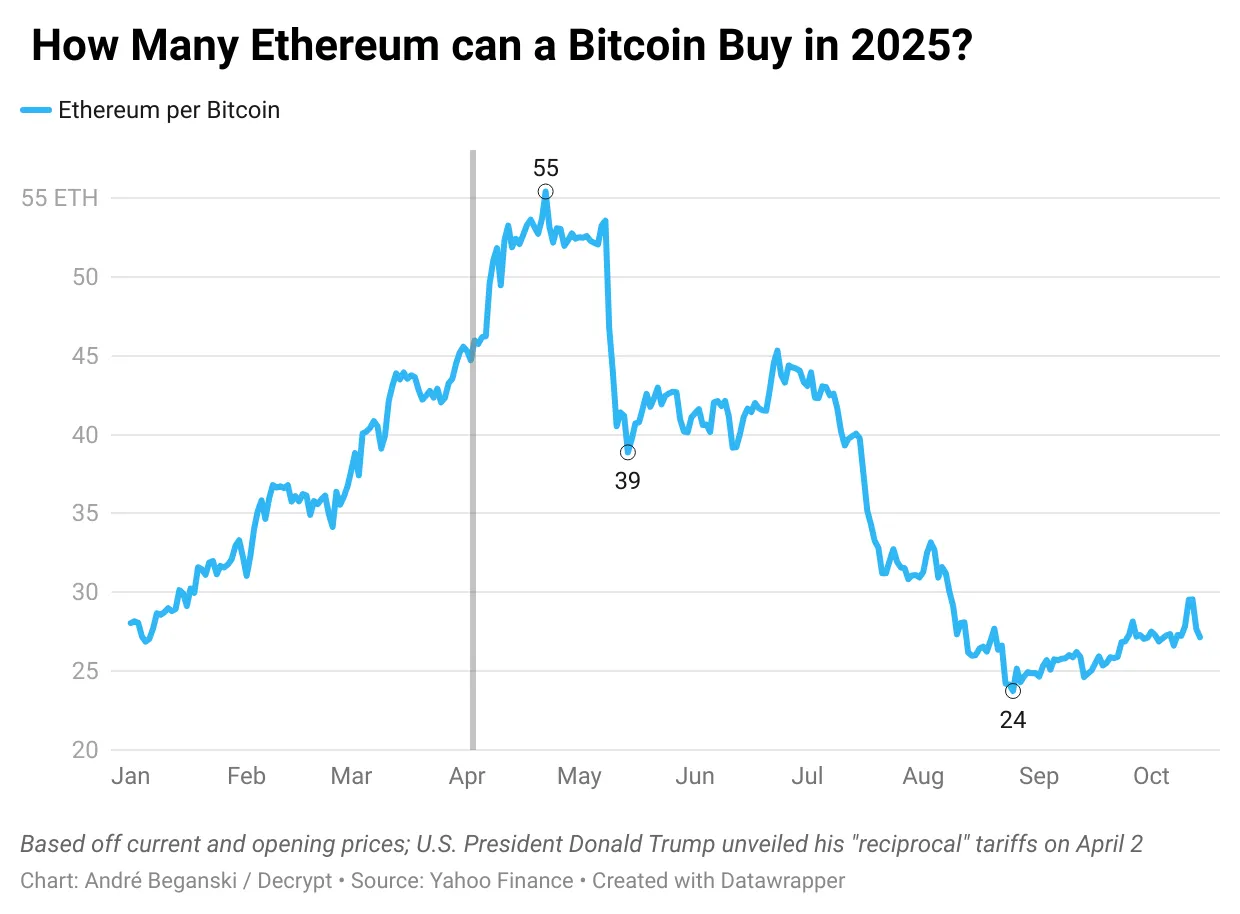

Bitcoin Reasserts Dominance Over Ethereum as Trump Trade Spat Escalates

In brief Bitcoin gained against Ethereum as Trump’s latest tariff threat weighed on markets. Despite recently losing ground, Ethereum is still outperforming Bitcoin this year. Some analysts foresee an altcoin rally, while others are doubtful. Ethereum surged against Bitcoin on its way toward a peak of nearly $5,000 this summer, but the reigning cryptocurrency reasserted…